Why Britannia Industries, Sun Pharma and Manappuram Finance have outperformed peers enjoying strong growth, the companies are likely to see their share prices rise

In recent months, stocks of Infosys, TCS, Hexaware, HCL Tech, Tech Mahindra and Wipro have risen smartly on the back of a strong recovery in the IT services sector. And when a sector undergoes a slump, there is a sell-off.

Banking stocks are currently down in the dumps as the sector navigates rocky terrain. However, some stocks can outperform their peers in the sector by a significant margin. Why does the market have such a contrasting view on stocks? Is the company placed better than its peers? Or is the share price driven by speculation or rumours rather than fundamentals?

We look at three stocks that have bucked the trend in their respective sectors and analyse the causes.

Britannia Industries

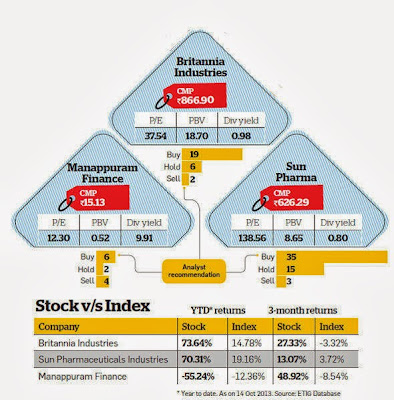

Until recently, FMCG stocks were being lapped up by investors as defensive bets in an uncertain market. In the past few months, the sector has cooled off, albeit slightly. However, Britannia Industries continues to soar in value. The stock has jumped 27% in the past three months, even as the sector (ex-Britannia) remained flat at -3%. On a year-todate basis also, the stock has zoomed 74% while the sector has posted only 4.9% gains.

The stock has got re-rated after the company showed improvement in operating margins, cash flows and return ratios over the past two quarters. With the recent change of management, Britannia has rejigged its product portfolio, foraying into breakfast cereals, milk and premium biscuits. This richer product mix, along with weak commodity prices is expected to help the company sustain its operating margins going forward.

Despite the recent run-up in the stock, analysts are still bullish on Britannia as it trades at a discount compared to its peers, as also the continued momentum in earnings growth expected over the coming years.

Ruchita Maheshwari, analyst, Nirmal Bang Securities, says, "Britannia has the potential to re-rate further owing to the strong brand portfolio, sales mix improvement, cost cutting initiatives, cash generation from subsidiaries and change in management."

Sun Pharma

Pharma is another defensive play but the sector has lost some of its sheen in the past few months. But Sun PharmaBSE -0.11 % has risen 13% over the past 3 months, when the sector (ex-Sun and ex-Wockhardt) has gained only 4%.

n fact, with a 70% rise over the past 10 months (as compared to 8.6% for the sector), the stock has surpassed index heavyweights Hindustan UnileverBSE 0.35 % and Bharti AirtelBSE -1.14 % in market-capitalisation during this period.

Sun Pharma shares shot up after its only rival selling the anti-cancer drug Doxil in the US, announced a shortage in supply due to some production issues. It is a windfall for Sun Pharma because it is now the sole supplier of the drug in the US. Analysts believe Sun could repeat last year's success with Doxil generic as a result of this.

Apart from this, Sun Pharma has shown good growth in the US generics space, further boosted by the acquisition of Dusa and URL. With a strong pipeline of drugs pending the US FDA's approval, Sun is expected to continue posting strong growth. However, the recent spike in the share price does not leave much room for an upside. Wait for dips to buy the stock.

Manappuram Finance

Shares of the gold finance firm have had a volatile run in 2013. The share price fell by 78% after gold prices plunged and slippages in asset quality spooked investors who earlier believed that gold loan business is secure due to the liquidity of the underlying asset. The company sharply cut its profit estimates for the March quarter due to the rise in defaults.

However, over the past three months, Manappuram's shares have climbed 49% even as the financial services sector has lost 5.7% of its value during this period. The rebound in gold prices has been the primary factor behind this jump. With gold prices again trading at high levels, the concerns on asset quality have diminished. The company has also kept the loan-to-value (LTV) ratio of fresh gold loans at around 60-75%, which lends comfort on loan recovery.

Sharper focus on collections is likely to lower the credit risk in the long run. However, disbursements continue to be on the lower side, which will keep the loan book growth subdued in the near term. With the valuations still on the lower side, analysts believe that the risk-reward ratio has turned in favour of investors.

Ishank Kumar, analyst, Religare Institutional Research, says, "While a correction in gold prices remains a risk, lower LTVs and an enhanced focus on early collection of interest should reduce credit risks in the long term." Approach this stock with caution as it is highly susceptible to a fall in gold prices.

Banking stocks are currently down in the dumps as the sector navigates rocky terrain. However, some stocks can outperform their peers in the sector by a significant margin. Why does the market have such a contrasting view on stocks? Is the company placed better than its peers? Or is the share price driven by speculation or rumours rather than fundamentals?

We look at three stocks that have bucked the trend in their respective sectors and analyse the causes.

Britannia Industries

Until recently, FMCG stocks were being lapped up by investors as defensive bets in an uncertain market. In the past few months, the sector has cooled off, albeit slightly. However, Britannia Industries continues to soar in value. The stock has jumped 27% in the past three months, even as the sector (ex-Britannia) remained flat at -3%. On a year-todate basis also, the stock has zoomed 74% while the sector has posted only 4.9% gains.

The stock has got re-rated after the company showed improvement in operating margins, cash flows and return ratios over the past two quarters. With the recent change of management, Britannia has rejigged its product portfolio, foraying into breakfast cereals, milk and premium biscuits. This richer product mix, along with weak commodity prices is expected to help the company sustain its operating margins going forward.

Despite the recent run-up in the stock, analysts are still bullish on Britannia as it trades at a discount compared to its peers, as also the continued momentum in earnings growth expected over the coming years.

Ruchita Maheshwari, analyst, Nirmal Bang Securities, says, "Britannia has the potential to re-rate further owing to the strong brand portfolio, sales mix improvement, cost cutting initiatives, cash generation from subsidiaries and change in management."

Sun Pharma

Pharma is another defensive play but the sector has lost some of its sheen in the past few months. But Sun PharmaBSE -0.11 % has risen 13% over the past 3 months, when the sector (ex-Sun and ex-Wockhardt) has gained only 4%.

n fact, with a 70% rise over the past 10 months (as compared to 8.6% for the sector), the stock has surpassed index heavyweights Hindustan UnileverBSE 0.35 % and Bharti AirtelBSE -1.14 % in market-capitalisation during this period.

Sun Pharma shares shot up after its only rival selling the anti-cancer drug Doxil in the US, announced a shortage in supply due to some production issues. It is a windfall for Sun Pharma because it is now the sole supplier of the drug in the US. Analysts believe Sun could repeat last year's success with Doxil generic as a result of this.

Apart from this, Sun Pharma has shown good growth in the US generics space, further boosted by the acquisition of Dusa and URL. With a strong pipeline of drugs pending the US FDA's approval, Sun is expected to continue posting strong growth. However, the recent spike in the share price does not leave much room for an upside. Wait for dips to buy the stock.

Manappuram Finance

Shares of the gold finance firm have had a volatile run in 2013. The share price fell by 78% after gold prices plunged and slippages in asset quality spooked investors who earlier believed that gold loan business is secure due to the liquidity of the underlying asset. The company sharply cut its profit estimates for the March quarter due to the rise in defaults.

However, over the past three months, Manappuram's shares have climbed 49% even as the financial services sector has lost 5.7% of its value during this period. The rebound in gold prices has been the primary factor behind this jump. With gold prices again trading at high levels, the concerns on asset quality have diminished. The company has also kept the loan-to-value (LTV) ratio of fresh gold loans at around 60-75%, which lends comfort on loan recovery.

Ishank Kumar, analyst, Religare Institutional Research, says, "While a correction in gold prices remains a risk, lower LTVs and an enhanced focus on early collection of interest should reduce credit risks in the long term." Approach this stock with caution as it is highly susceptible to a fall in gold prices.

Courtesy: The Economic Times